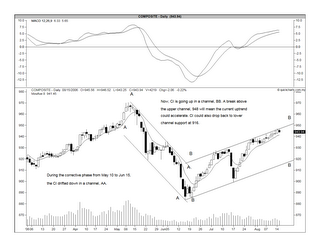

Chart 1: CI's daily chart as at August 15

The only excitement is in the Plantation sector. The Plantation index is well-supported by its ST uptrend line at 3500 level (see Chart 2 below). The Plantation theme play is starting to broaden out to include some second- & third-liners. One such share is Unico-Desa, which I have made a trading call on Unico-Desa on August 3 when it broke above the RM0.53 horizontal resistance.

Eventhough I am optimistic about the current prospect of the plantation sector, I'm also very cautious as a lot of good news has already been factored into the price, especially amongst its leaders such as IOI, KLK & PPB Oil. The rise of the cheaper stocks could signal the blow-out stage of the plantation theme play. The rewards at this stage are high, as are the risks. As usual, my advice is to have protective stop loss whenever you open a position in this kind of market. Good luck.

Chart 2: Plantation's daily chart as at August 15

No comments:

Post a Comment