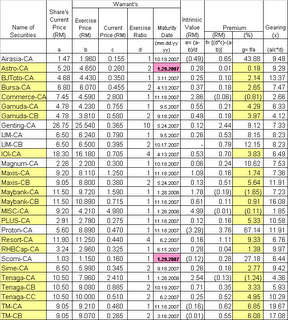

I’ve updated the list of call warrants. See Table 1 below.

Table 1: List of call warrants as at Nov 14

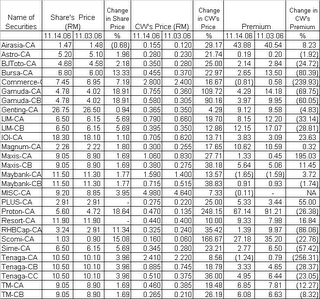

The call warrants have out-performed the broader market by a large margin (see Table 2 below). The percentage gain for call warrants averages about 40.2% vis-a-vis a gain of 5.5% for the mother shares. The average premium has increased from 8.6% to 11.4%.

Table 2: Change in the price of call warrants, shares & premium from Nov 3 to Nov 14

So, those who have invested in call warrants would have made very good return in the current bullish market. As the premium is still low (as compared to 20-30% in a well-recognized bull market), call warrants will still hold an appeal to many, especially those who adopt a more short-term approach in their trading/investing. As always, an instrument that afford leverage exposure will enhance return as well as the accompanying risk. Off hand, a few call warrants that appeal to me are call warrants for Tenaga, Astro and, maybe, Maxis.

No comments:

Post a Comment