TM has broken above its medium-term downtrend line at RM9.00 on November 7. Thereafter it continued to drift sideway. Besides the downtrend line, TM share price also faces a strong horizontal resistance of RM9.20, which has been in place since June.

Chart 1: TM's weekly chart as at Nov 15

Chart 2: TM's daily chart as at Nov 15

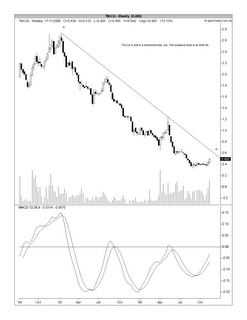

For the traders, you may like to try out TM-CA, the call warrant of TM, with an exercise ratio of 1:1; an exercise price of RM9.21 & expiring on November 18, 2007. At the price of RM0.595 at the close of this morning session (with the mother price of RM9.45), TM-CA is trading at a premium of 3.8% only. Chartwise, TM-CA hasn’t broken above its downtrend line yet, even after this morning’s sharp rise (see Chart 3 below). To achieve a breakout, TM-CA needs to surpass the RM0.65/66 level.

Chart 3: TM-CA's weekly chart as at Nov 15

In conclusion, I believe TM is now a good buy after this morning’s breakout. Even though TM-CA hasn’t broken above its downtrend line yet, I believe it is likely to happen soon. A good entry for TM is probably now. TM-CA is trickier but a gradual entry starting now would be safer (without missing the boat).

No comments:

Post a Comment