The biggest contribution to MPI's big net profit jump is its improving gross profit. The gross profit margin has increased from 12.2% for QE31/12/05 to 14.4% for QE31/3/06 to 16.3% for QE30/6/06 to finally to 22.4% for QE30/9/06.

Based on the latest quarterly EPS of 23.16 sen, MPI's full-year EPS is estimated to be about 92.64 sen. At a closing price of RM9.90 yesterday (Oct 31), MPI is trading at a PE of 10.7 times.

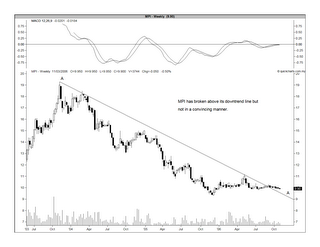

Technically speaking, MPI has broken above its downtrend line in September but the stock has been drifting sideway. Maybe, the continuous flow of good results would act as a catalyst for a re-rating of MPI.

Chart: MPI's weekly chart as at Oct 31

No comments:

Post a Comment