Due to the sharp rise in net profit, Tongher's EPS for QE30/9/2006 is at 24.39 sen. If this earning can be maintained going forward, Tongher's EPS for full-year could be as high as 97.56 sen. At 3.00 p.m. (November 29), Tingher is trading at RM4.00. At this price, Tongher's PE is about 4.1 times, which is still relative inexpensive.

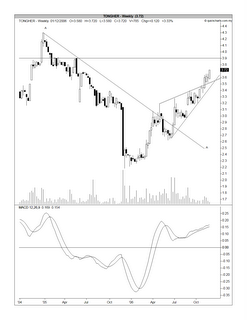

From the weekly chart below, you can see that Tongher has broken out of its rising wedge at RM3.50 level in October. The next resistance was RM3.90, which was broken today. Tongher could revisit its high of RM4.30 recorded in December 2004.

Based on cheap valuation, I believe Tongher is still attractive investment despite having risen by about 80% in the past 12 months (i.e. from RM2.20 in December 2005 to RM4.00 at 3.00 p.m. today).

No comments:

Post a Comment