Possible valuation

One way of valuing MBSB is by the book value method, which is often used in the valuation of bank acquisition in Malaysia. A recent example is CIMB's acquisition of SBB at 2-time the latter book value. Of course, we cannot use a high multiple of 2 times for MBSB due to its niche operation and run-of-the-mill brand recognition, but a value of say 1.2 times could be justifiable. At that multiple, MBSB may be worth about RM1.38. This would translate into a company trading at a PE of 10.9 times, which is fairly reasonable.

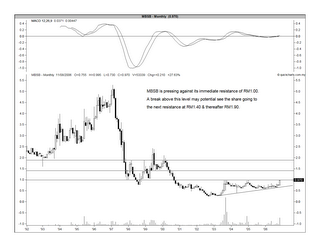

Technical Outlook

From the monthly chart (Chart 1), we can see that MBSB was at the strong resistance of RM1.00 yesterday. A break above this RM1.00 level could see MBSB testing its next resistance of RM1.40 and, thereafter, RM1.90. A clearer picture is given by the weekly & daily charts (Chart 2 & 3). From Chart 2, we can see that MBSB has a medium-term uptrend line support at RM0.65 while its strong horizontal support is RM0.60 (see Chart 2). But the immediate horizontal support will be at RM0.82, if this current sharp run were to fizzle out (see Chart 3).

Chart 1: MBSB's monthly chart as at Nov 8

Chart 2: MBSB's weekly chart as at Nov 8

Chart 3: MBSB's daily chart as at Nov 8

Conclusion

MBSB could be in for an interesting time. If it can break above RM1.00 convincingly, you may want to trade it on the way up to RM1.40. If the current speculation leads to nothing and the prices were to retreat back to much lower level, you may want to enter this stock at the safer level of RM0.60-0.70. Finally, we can take comfort in knowing that the stock is not expensive based fundamental valuation.

No comments:

Post a Comment