Hume Industries (M) Bhd is involved in the manufacturing and sale of concrete products, pre-cast pipes, fibre-cement products & concrete roofing tiles as well as medium density fibreboard.

Recent Financial Results

Hume’s net profit for the QE30/6/06 increased by more than 2 folds to RM12.5 mil from RM3.7 mil recorded in the preceding quarter, while its turnover for the same periods has increased by 10.6% from RM135.8 mil to RM150.2 mil. When compared to the previous corresponding quarter, its net profit is lower by 38.8% while turnover declined by 3.4%.

Hume’s latest 4 quarters’ turnover has inched up by 1.8% to RM600 mil when compared to the turnover of the preceding 4 quarters. At the same time, the net profit for the latest 4 quarters, which totaled RM27.9 mil, is 66.1% lower than the earlier 4 quarters. Consequently, its EPS dropped 65.2% from 43.7 sen to 15.2 sen. See the table below.

Valuation

Based on the last 4 quarters’ EPS of 15.2 sen & yesterday’s closing price of RM3.32, Hume is now trading at a PE of 21.8 times. This is fairly expensive unless Hume’s financial results is about to change substantially in the near future. This cannot be ruled out as its EPS in the preceding 4 quarters were quite high at 43.7 sen. At this EPS number, Hume would only be trading at a PE of 7.6 times.

Technical Outlook

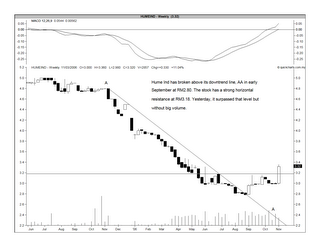

Hume has broken above its medium-term downtrend line in September. Since then, it has been moving in a sideway manner with the strong horizontal resistance at RM3.18/20 level. Yesterday, it has broken above this resistance and this could be the beginning of the bullish phase for Hume. See the weekly chart below.

Chart: Hume's weekly chart as at Nov 2

Conclusion

Based on the positive technical outlook, Hume could be in for a bullish phase. Its fundamentals are still not very convincing but I expect further improvement with more projects in the pipeline due to the 9MP.

No comments:

Post a Comment