Pentamaster is involved in the provision of manufacturing automation solutions, specializing in the production of tailor-made systems and automated equipment. One of the main markets for its systems & equipment is the semiconductor assmebly sector.

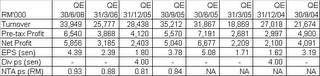

Recent Financial Results

Pentamaster’s latest financial result is for QE30/6/06. Its net profit has increased by 83.9% q-o-q from RM3.2 mil to RM5.9 mil on the back of a 31.7%-increase in turnover from RM25.8 mil to RM33.9 mil. When compared to the previous corresponding quarter, its net profit has declined 12.3% while turnover was up 6.5%.

When comparing the latest 4 quarterly results with the preceding 4 quarterly results, we can see that net profit has increased by 9.3 % from RM15.1 mil to RM16.5 mil, while turnover was up 24.1% from RM99.4 mil to RM123.4 mil. EPS for the 2 periods was up 6.6% from 11.6 sen to 12.4 sen. See the table below.

Valuation

Based on the latest 4 quarterly EPS totaling 12.4 sen & its closing price of RM1.00, Pentamaster is now trading at a PE of 8.1 times.

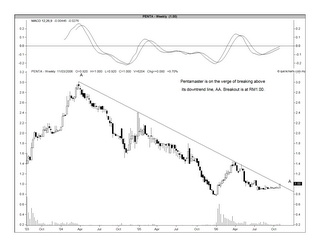

Technical Outlook

Pentamaster has been in a downtrend after achieving a high of RM3.01 in March 2004. Yesterday, the share price gained 6.5 sen to close at RM1.00, which is right on the downtrend line itself. At the close of this morning, Pentamaster share price has broken above the downtrend line when it rose 5 sen to RM1.05. See the chart below.

Chart: Pentamaster's weekly chart as at Oct 31

Conclusion

Based on positive technical outlook, I believe Pentamaster could be a good medium-term investment.

No comments:

Post a Comment