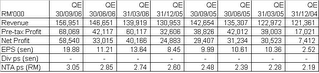

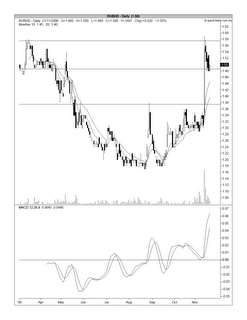

In August, I’ve highlighted that RUBhd has broken above its medium-term downtrend line at the RM1.28/30. Since then, the share has been carrying out a bottoming process with advances capped at RM1.38. On November 14, RUBhd share price made a big move on the upside which effectively cleared the RM1.38 resistance as well as the next horizontal resistance of RM1.50. It stopped just short of the following horizontal resistance of RM1.60. See the weekly & daily charts below.

Chart 1: RUBhd's weekly chart as at Nov 21

Chart 1: RUBhd's weekly chart as at Nov 21

Chart 2: RUBhd's daily chart as at Nov 21

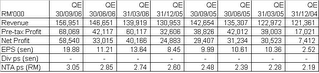

The reason for the big price movement was the announcement of its result for QE30/9/2006 where RUBhd’s net profit jumped 77% q-o-q or 99% y-o-y to RM58.5 mil on the back of a turnover of RM157 mil, which represents a gain of 7% q-o-q or 10% y-o-y. With this oversized improvement in net profit, RUBhd’s EPS had also increased to 19.88 sen. If it can maintain this performance, RUBhd’s full year EPS could touch 79.52 sen. The improved performance was attributable to higher margin which flows from the restructuring of the water concessions operation in the State of Johor (see the earlier post). The last 8 quarterly results are tabulated below.

After the big price move mentioned earlier, RUBhd share price has retraced back to RM1.48. Today, it has begun to move up again. The share closed at RM1.56 at the end of the morning session, gaining 6 sen on a volume of 4,276 lots. At this price & assuming a full year EPS of 79.52 sen, RUBhd is trading at a PE of 2.0 times only. Hard to believe…

2 comments:

wah lau weh, good spot man! will tell more stock players about your blog, alex,

Just wondering where you collect the warrant/ca info from (exer, no of CA etc)?

it has moved a fair bit since you spotted the trend reversal.... wat about doing another TA update on RUBHD... is it weakening? or poise to another surge... thanks!

Post a Comment