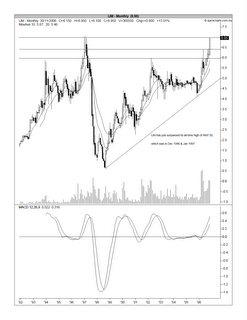

Chart 1: IJM's monthly chart as at Nov 23

Before we proceed further, let’s recap some outstanding significant corporate exercises that may have impact investors’ opinion on IJM. A few weeks ago, IJM has proposed to takeover of Road Builders in a deal which effectively swaps 2 Road Builders shares for 1 IJM new share. In addition, the market is also awaiting the confirmation of IJM’s acquisition of a stake in Kumpulan Euro, with the stumbling block being the finalization of the latter’s concession agreement with the State Government of Selangor regarding the development of the

As a technical rule, a stock that has made a new high has the tendency to continue to go higher. As such, IJM could be in for a very interesting time. Having said that, I like to introduce you to another technical rule; one that’s not so well-known. In the book, Trader Vic - Methods of a Wall Street Master, Victor Spenrandeo has made this observation: “In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse." That’s something that we must watch out for in the next few trading days- whether IJM share price may slide back below the RM7.05 level.

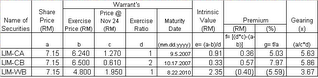

The big question is how do you gain entry into this developing play, besides buying into IJM. You can do anyone of the following:

- Buy Road Builders; or

- Buy IJM-CA or IJM-CB or IJM-WB.

Buying Road Builders to ride on IJM's rise is relatively safe since the IJM-Road Builders deal, being a friendly deal, is likely to be completed. As the Road Builders share shall be exchanged for IJM share at a ratio of 2:1, you should buy Road Builders at a price not exceeding RM3.55. In fact, you should build in a discount of 3 to 5% to take into account of the risk of the IJM-Road Builders deal may somehow falter.

Here, we have a very strange situation of IJM-WB trading at a discount of 40 sen or 5.6%. This doesn’t seem right. It gives rise to a situation where one can simply buy IJM-WB & exercise the conversion option by paying the exercise price of RM4.80 & thereafter disposing off the share at a profit of RM0.40 [IJM price of RM7.15 less (IJM-WB price of RM1.95 plus exercise price of RM4.80)]. In fact, the volume traded last Friday of 76,245 lots (or, 7.6245 million units) indicates that some investors may have spotted this discount & were buying quite substantially. The question is why are the sellers so willing to sell at a discount? In the past, I have noticed that such anomalies could persist for sometime, say a few days or even a few weeks. The longer this discount persists, the greater is the chance that the share price will correct. This is only natural as demand (for the share) will eventually be fulfilled by unending supply as more shares are created due to the investors’ exercising their warrants (i.e, IJM-WB) for new shares.

So, over the next few days, watch out for IJM share price as well as IJM-WB price. If IJM share price drop below RM7.05 or the discount persist for IJM-WB, you are forewarned that this 'new high' may not sustain.

No comments:

Post a Comment