Pelikan is involved in the manufacturing & distribution of writing instruments, art, painting & hobby products, office stationeries & printing consumables. Prior to April 2005, Pelikan (formerly, Diperdana) was involved in the provision of logistics & related services. This business was sold off to Konsortium Logistik Bhd.

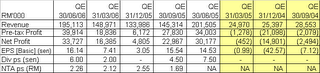

Recent Financial Performance

Pelikan’s net profit for QE30/6/2006 has doubled to RM33.7 mil from RM16.4 mil achieved in the preceding quarter i.e. QE31/3/2006. Turnover has increased by 31% during the same periods. The better performance was mainly attributable to the higher sales recorded in the current quarter and operational efficiency due to higher sales volume. The latter was resulted from the “back to school” season in Europe and Latin America.

When compared to the previous corresponding quarter, net profit has increased by 12% while turnover has declined marginally by 3%. For more details, see the table below.

(Note: The changeover of business operations i.e. from the previous logistics operation to the current manufacturing opeartion is clearly demarcated in the table above. The yellow portion is for the previous loss-making operation.)

Valuation

Based on the past 4 quarters' basic EPS of 35.1 sen (amended to reflect the 1:5 Bonus completed in September) and the trading price of RM2.95 as at 10.30 a.m. today, Pelikan is now trading at a PE of 8.4 times. Pelikan's diluted EPS for the same 4 quarters is 24.2 sen, and this means that Pelikan's PE is 12.2 times (based on diluted EPS).

Technical Outlook

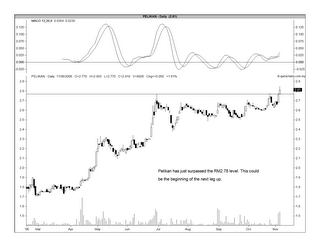

Pelikan has broken above its resistance of RM2.78/80 yesterday. This could be the beginning of the next leg up for this stock. See the charts below.

Chart 1: Pelikan's daily chart as at Nov 6

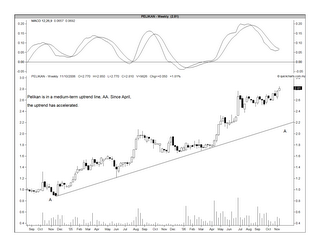

Chart 2: Pelikan's weekly chart as at Nov 6

Conclusion

Based on attractive technical set-up & reasonable fundamentals, I believe Pelikan is a good stock for a medium-term investment (or, even a trade).

No comments:

Post a Comment