Scicom's share price has been rising steadily from a recent low of RM0.345 on June 12, 2006 to a high of RM0.665 on October 31. The sharp rise coincided with a 1-for-1 bonus issue that was complated in October. Since then, the share price has been drifting down & it may soon test its uptrend line support at RM0.53 (& rising). This would be a very good level to make your entry into Scicom. See the daily chart below.

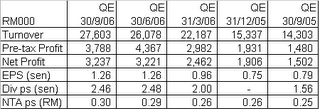

Based on a theoretical entry price of RM0.53 & the full year's EPS of 5.04 sen (based on the latest EPS of 1.26 sen for QE 30/9/06), Scicom is trading at a PE of 10.5 times. That's quite attractive for a stock that is enjoying such a strong growth.

No comments:

Post a Comment